how much is inheritance tax in nc

Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains. There is no inheritance tax in NC.

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

A surviving spouse is the only person exempt from paying this tax.

. How Much is Inheritance Tax. Home File Pay. 3 Is inheritance taxable in North Carolina.

The legal process of dealing with a decedents estate in North Carolina is known as probate. 6 Do beneficiaries have to pay taxes on inheritance. There is no federal inheritance tax but there is a federal estate tax.

No Inheritance Tax in NC. These are some of the taxes you may have to think about as an heir. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

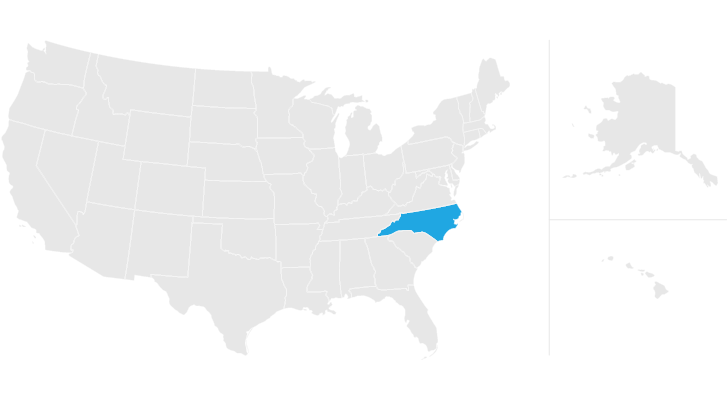

North Carolina doesnt collect inheritance or estate taxes. When an heir is notified of their inheritance they should carefully review assets in light of their unique tax situation with a North Carolina tax lawyer. According to the new 10-year payout rule inherited IRAs that distribute large amounts of.

While North Carolinas estate tax was repealed in 2013 other taxes may apply to an inheritance. Income Tax Return for Estates and Trusts each year that the trust has 600 in income or has a non-resident alien as a beneficiary. North Carolina does not collect an inheritance tax or an estate tax.

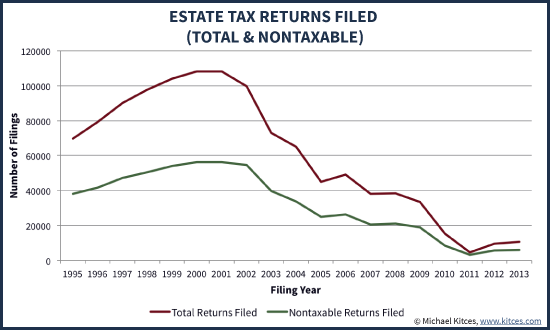

In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The tax rate on funds in excess of the exemption amount is 40. For Tax Year 2019 For Tax.

See below for a chart of historical Federal estate tax exemption amounts and tax rates. No Inheritance Tax in NC. However there are sometimes taxes for other reasons.

Find out what an inheritance tax is whether your state has one and if so how much you might have to pay. Initiatives were floated to repeal Nebraskas inheritance tax and North Carolinas estate tax in 2012 but nothing happened on this front in Nebraska. There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it.

5 Does the IRS know when you inherit money. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. 4 Does North Carolina have an estate tax or inheritance tax.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. How Long Does It Take to Get an Inheritance. Skip to main content Menu.

Gifts of less than 16000 per year per individual are not taxed. The legal process of dealing with a decedents estate in North Carolina is known as probate. Inheritance tax is imposed on the assets inherited from a deceased person.

The current Federal Estate Tax Exemption for 2021 is 117 million per individual. However there are sometimes taxes for other reasons. However state residents should remember to take into account the federal estate tax if.

7 Do seniors have to pay capital gains tax. 2 Do I pay capital gains tax if I sell an inherited property. Annual Gift Tax Exclusion.

There are six as of 2022. Mangum St 6th Fl Durham NC 27701. The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to 1206 million for deaths in 2022.

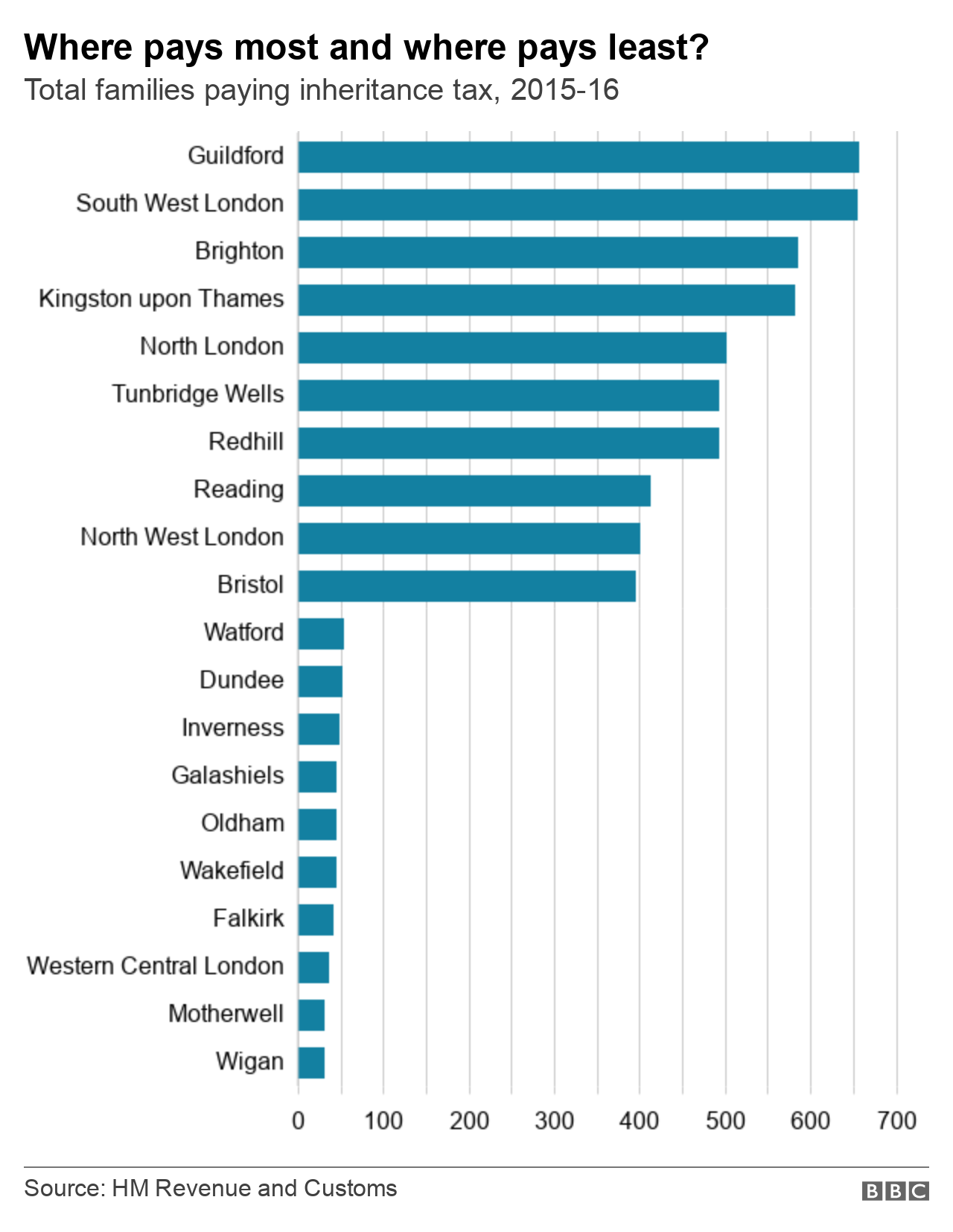

Only six states impose an inheritance tax but who has to pay inheritance tax varies from state to state and tax rates can range from 1 up to 16. Inheritances that fall below these exemption amounts arent subject to the tax. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million. 1-800-959-1247 email protected 100 Fisher Ave. PO Box 25000 Raleigh NC 27640-0640.

1 Do you have to pay taxes on inherited property that was sold. If you are planning your estate you can also pay for certain non-taxable expenses for children or grandchildren such as tuition for college or medical bills for your loved ones. Some states and a handful of federal governments around the world levy this tax.

Put another way that means that you have a 998 chance of never having to worry about estate taxes. Which states have an inheritance tax. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all decedents in 2015.

By Staff Writer Last Updated April 05 2020. Individual income tax refund inquiries. North Carolina Department of Revenue.

Tax implications depend on the type of asset the value and other factors. However state residents should keep federal estate taxes in mind if their estate or the estate they are inheriting is worth more than 1206 million in 2022. While there isnt an estate tax in North Carolina the federal estate tax may still apply.

Trusts must file a Form 1041 US. For 2022 the annual exclusion is 16000. The tax rate on inheritances depends on.

New Irs Requirements To Request Estate Closing Letter

401 K Inheritance Tax Rules Estate Planning

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is There A Federal Inheritance Tax Legalzoom Com

Calculating Inheritance Tax Laws Com

North Carolina Estate Tax Everything You Need To Know Smartasset

Guildford Is The Inheritance Tax Capital Of The Uk Bbc News

2020 Estate And Gift Taxes Offit Kurman

North Carolina Estate Planning Blog Where Not To Die

Map Of Earned Income Tax Credit Eitc Recipients By State Map Happy Facts Teaching Geography

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Where Not To Die In 2022 The Greediest Death Tax States

Federal Gift Tax Vs California Inheritance Tax

North Carolina Estate Tax Everything You Need To Know Smartasset

In Addition To The Federal Estate Tax Which Is Fourth Highest In The Oecd Many U S States Levy Their Own Estate Inheritance Tax Estate Tax Estate Planning

Eight Things You Need To Know About The Death Tax Before You Die